Cryptocurrency has become a major topic in recent years. Its popularity has grown tremendously, especially in the last two to three years. In the past, investing in crypto was seen only as an alternative investment. Now, it is treated as a serious and viable part of an investment portfolio. Some people even include it in their retirement plans. This content will explain the growth of blockchain and cryptocurrency solutions and their influence across various sectors.

Cryptocurrency as a Mainstream Asset

Cryptocurrency is now a mainstream investment asset class. Many people are excited to invest in this innovative digital asset. Some buy crypto for short-term speculation, hoping to make quick money. Others use crypto to diversify their investment portfolio. This means they move some money away from traditional assets like shares, bonds, or property. Currently, the cryptocurrency market is unregulated. This lack of regulation means people often do not know where or how to begin investing. This makes the investment process difficult at times.

The popular phrase in the crypto world is “do your own research” (DYOR). This means you must fully understand what you are buying. You also need to understand the potential risks. People must be fully aware of the scams and risks associated with cryptocurrency investment. You should always be financially prepared to lose all the money you have invested. Some crypto assets attract investors based on the principles of the developers. Others appeal to investors because of the real-world use case for the token itself. What is the blockchain and cryptocurrency landscape?

Growth Drivers of Cryptocurrency

The cryptocurrency market is experiencing a steady increase in its market value. One key reason for this growth is the consumer protection provided by blockchain technology. This technological safeguard helps the cryptocurrency market remain strong, even during times of volatile market conditions. Blockchain technology is crucial in protecting consumers in the digital asset space. The global cryptocurrency market is seeing significant expansion. The market size was estimated at $4.57 billion in 2022. It is expected to rise at a rate of 12.5% to reach $13.18 billion by 2030.

The global cryptocurrency market cap is currently estimated at a massive $1.23 trillion. Cryptocurrencies, or virtual currencies, exist only in a digital form. They currently have no single regulatory authority. These currencies rely on distributed ledger technology (DLT), mainly blockchain, to validate and record all transactions. The increasing adoption of DLT is expected to strongly drive the growth of the cryptocurrency market in the coming years.

Latest Market Data and Projections

The global cryptocurrency market has experienced massive growth and volatility since 2022. Recent reports indicate that the total market capitalization for cryptocurrencies has fluctuated greatly. As of recent estimates, the global crypto market cap has reached well over $3 trillion at certain points, showing a significant surge in value compared to the $1.23 trillion mentioned in the original text. The market continues to be highly volatile, with values changing daily. The overall trend shows that institutional adoption and clarity in regulation are strong drivers for this continued market expansion. What is the blockchain and cryptocurrency landscape?

Recent Developments and Impact of AI on Crypto

Artificial Intelligence (AI) is having a huge impact on the cryptocurrency market. The increasing demand for AI-based cryptocurrency platforms is causing many companies to focus on AI technology development.

One major factor fueling the growth of digital currency is the increasing number of businesses that accept cryptocurrency as a formal payment method. This includes major corporations globally adopting digital currency. This widespread acceptance is expected to drive further expansion of the industry. AI’s role is particularly transformative in-

Automated Trading

AI algorithms and bots can analyze vast amounts of market data much faster than humans. They can execute trades with high precision, eliminating emotional biases like fear or greed.

Risk Management

AI excels at simplifying the complex risk assessment needed for the volatile crypto market. It helps traders manage their portfolios more optimally.

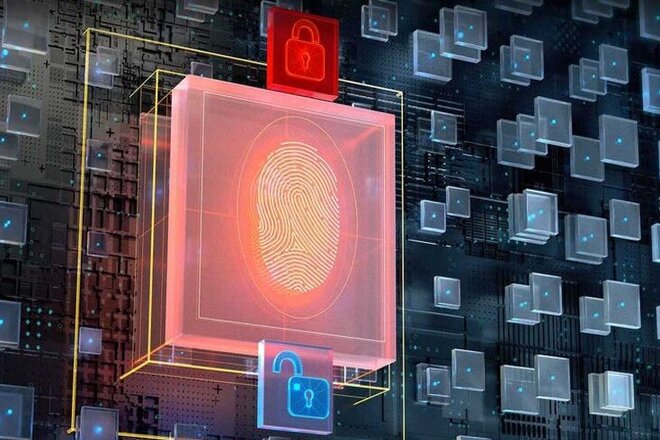

Security Enhancement

AI-powered security systems are being integrated into crypto platforms. This helps to detect and curb cybersecurity risks and threats, augmenting the security of digital assets.

Token Optimization

AI can be used to design better tokenomics models. This helps ensure a balanced relationship between the supply and demand for a token.

Global Regulatory Landscape

Government agencies around the world are now seriously focusing on drafting legislation to regulate cryptocurrencies. This movement aims to create clear rules for the fast-growing industry. The adoption of cryptocurrencies like Bitcoin is gaining significant attention in countries that suffer from high inflation. Citizens in these economies see Bitcoin as a potential store of value against the devaluation of their national currency.

A significant obstacle to market expansion, however, is the concern among regulators worldwide about the use of cryptocurrencies for illegal purposes. This includes money laundering and financing criminal activities. This concern is driving the push for stronger global regulations. Recent regulatory developments globally include –

Spot Exchange-Traded Funds (ETFs)

Many countries, including the United States, have approved ETFs tied to the spot prices of major cryptocurrencies like Bitcoin and Ethereum. This allows traditional investors to access crypto through familiar financial products.

MiCA in the EU

The European Union adopted the Markets in Crypto-Assets (MiCA) regulation. This is a unified framework for crypto regulation. It provides much-needed clarity on licensing and consumer protection for crypto service providers across the EU.

Stablecoin Rules

Many jurisdictions are creating specific rules for stablecoins, requiring issuers to maintain full reserve backing. This aims to ensure that stablecoins can be reliably redeemed for their face value while boosting market trust.

How Blockchain and Cryptocurrency Influence HR

Human Resource (HR) management handles a vast amount of sensitive personal and financial data. The HR department stores information related to payroll, health insurance, banking and finance details, and disciplinary records. All this data runs a high risk of being exploited by criminals. Blockchain technology offers a powerful solution to this security risk.

When records are stored on a decentralized blockchain, the possibility of criminals accessing this data is drastically reduced, sometimes becoming non-existent. There is no single central server for hackers to attack and damage. Furthermore, any change to the data can only be completed after getting authorized and verified by the network. The blockchain-enabled distributed ledger can be used to –

Verify Candidate Data

It can securely verify a job candidate’s past employment and educational data.

Manage Compensation and Benefits

Other sensitive information related to compensation and benefits can be added to blocks for administrative purposes.

Improve HR Compliance

Blockchain helps with reporting, auditing, and HR compliance processes.

Increase Efficiency

Reporting is made easier. HR staff can pull the relevant data from the general ledger or database without the need to tediously verify that data. This time saved can be used to improve overall efficiency in the department.

Web3.0 and the Future of the Internet

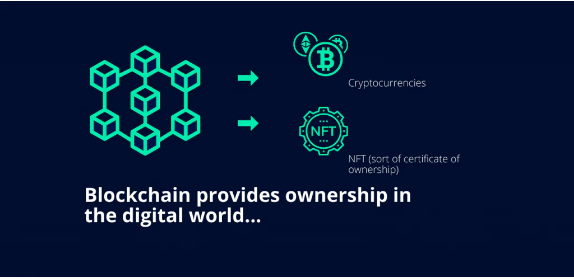

Web 3.0 is seen as the next generation of the Internet. It is fundamentally based on public blockchains, which are record-keeping systems that support cryptocurrency transactions.

Web 3.0 promises the generation of new applications and services based on blockchain technology. One of the most actively used applications today is Non-Fungible Tokens (NFTs). NFTs are a unique type of crypto-asset. They are used to create and validate the immutable ownership of digital assets, such as digital art or collectibles.

Blockchain provides a new system for creating consensus among network participants without needing government permission. Web3, on the other hand, is the decentralized web. In Web3, applications, online services, and financial systems no longer need a single centralized authority.

Blockchain and cryptocurrency are considered the fundamental building blocks of Web3. However, the decentralized web also incorporates other advanced technologies like Augmented Reality (AR), Virtual Reality (VR), and the Internet of Things (IoT), some of which may not directly involve blockchains or digital currencies. Ultimately, Web3 is defined as the third generation of the Internet, with blockchain technology at its core.

Rise of Blockchain and the Metaverse

Web 2.0 transformed the Internet into a highly social experience. Social networking sites and blogs introduced new ways for consumers to communicate. However, Web 2.0 still relies heavily on centralization for the online experience.

The adoption of blockchain infrastructure is fundamentally changing the Metaverse. The Metaverse is an immersive virtual world. Blockchain allows Metaverse users to connect with the broader crypto economy. This makes virtual items easily exchangeable for real money or economic value.

Blockchain technology enables Bitcoin and other cryptocurrencies to be used to buy and sell virtual assets within the Metaverse. NFTs play an extremely important role here. They provide a unique way of representing digital assets on a blockchain. These assets include virtual real estate, game items, digital merchandise, and collectibles. This framework gives these virtual items real economic value beyond the confines of a single platform.

Future Ahead

Cryptocurrencies are expected to be the main source of power for the Metaverse economy. If the Metaverse flourishes, cryptocurrencies will likely gain even more widespread acceptance and use. The renaming of Facebook to Meta Platforms by Mark Zuckerberg shows that a major technology company is counting on this success.

Custom blockchain and cryptocurrency solutions offer a vast range of applications. This technology has the potential to fundamentally change how almost every industry operates. For now, its full applications are somewhat limited. This is because only a growing number of companies currently fully understand the importance and power of this revolutionary tool.